As the David and Lucile Packard Foundation deepens its commitment to justice and equity in the United States, we are taking a hard look at how our Foundation can use mission investments – loans and equity investments – to advance racial equity by making capital available to communities of color who have long been denied it.

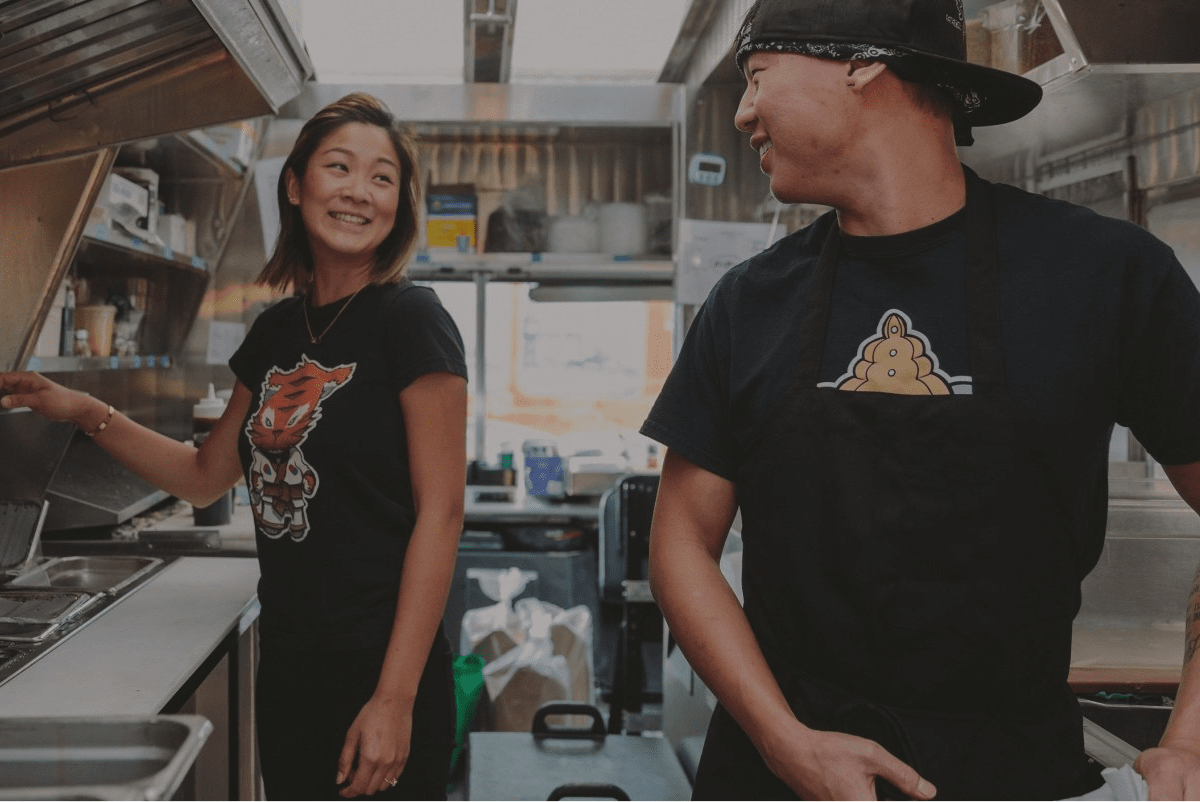

I am pleased to share that since September 2020 we have made six mission investments totaling $25 million to support Community Development Financial Institutions (CDFIs) and other organizations addressing racial equity credit disparities in the United States. Inequities in credit availability are among the most severe racial disparities in this country, second only to incarceration rates, and these inequities have only grown during the COVID-19 pandemic. The following investments made to six organizations are helping Black, Latinx, Indigenous, and other families of color stabilize their finances and housing, start and grow small businesses, and build wealth.

Blackstar Stability: $3 million equity investment to help launch the Distressed Debt Fund, a promising model for restructuring predatory housing loans into conforming mortgages. This Fund will address past predatory lending practices which disproportionately impact families of color and will help these same families significantly improve housing stability and build wealth.

Addressing deeply rooted racial disparities is a new focus for our mission investments, and our Mission Investing team explored how we can use our loans and equity investments to help break down barriers to financial inclusion. We learned from peer investors and CDFIs with long histories of using a variety of financing approaches to address discriminatory and predatory lending and to unlock credit for communities of color that have been underserved and left behind by the commercial banking system.

We look forward to growing these relationships and learning from the incredible teams leading their work to help families, business owners, and communities overcome racial equity credit gaps and other unjust barriers to wealth acquisition and stability. Through these new investments, our hope is that we not only support these organizations in achieving their missions, but that these partnerships inform our future mission investments, and that we can introduce these organizations’ work to impact investors looking to deepen their own racial equity investing.

Susan Phinney Silver is the Mission Investing Director for the David and Lucile Packard Foundation. More information about the Foundation’s use of mission investments as a tool for change can be found here.